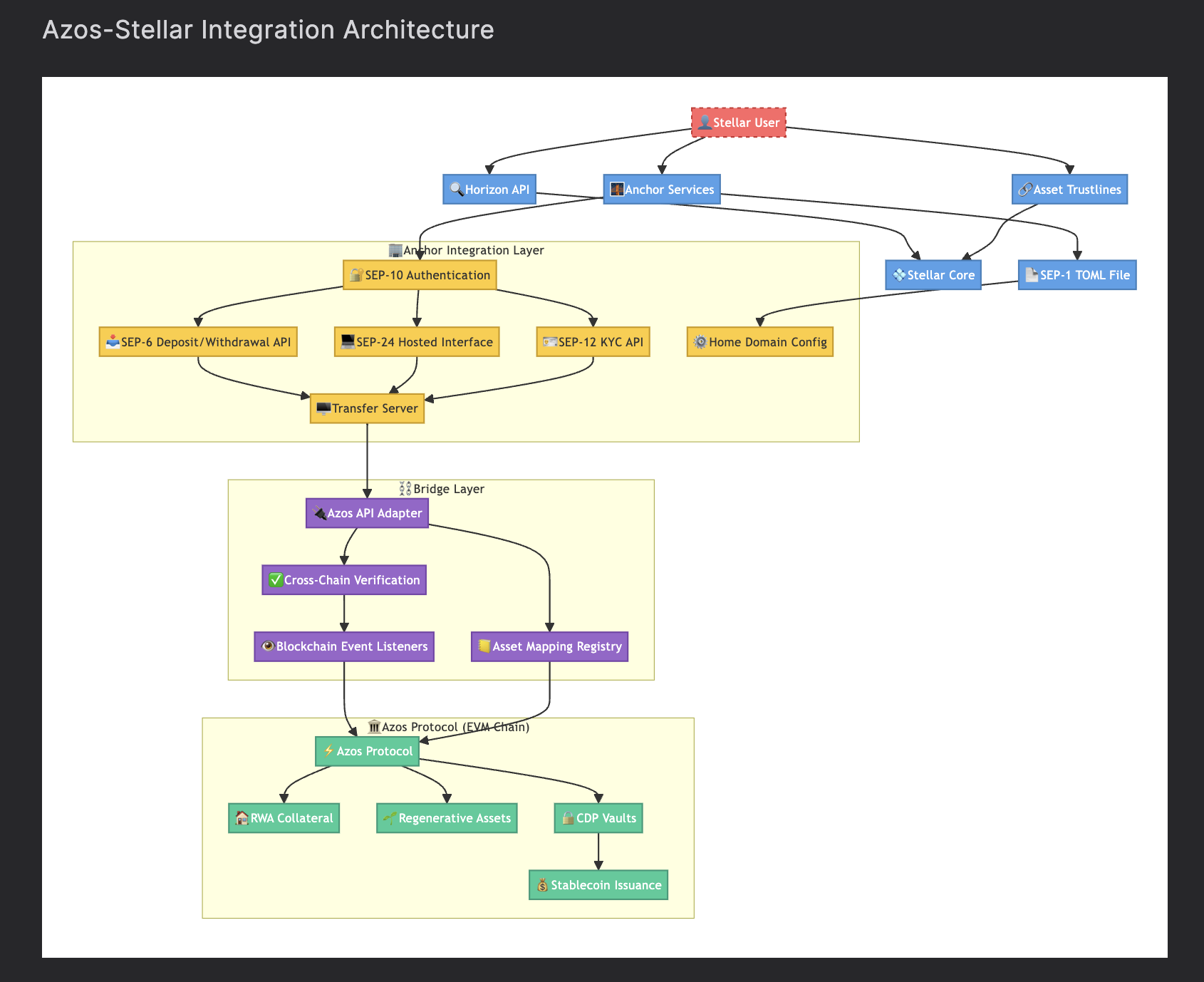

Azos-Stellar Integration Architecture

System Architecture

Image: Comprehensive view of the Azos-Stellar integration architecture showing all components and their connections

Key Components Explained

Stellar Network Layer

- Stellar Core: The backbone of the Stellar network that processes transactions

- Horizon API: REST API interface for interacting with the Stellar network

- Asset Trustlines: Establishes relationships between user accounts and issued assets

- SEP-1 TOML File: Configuration file hosted at your domain that defines anchor capabilities

Anchor Integration Layer

- SEP-10 Authentication: Secure, signature-based authentication for Stellar accounts

- SEP-6/24 Transfer APIs: Standards for handling deposits and withdrawals

- SEP-12 KYC API: User verification and compliance management

- Transfer Server: Central service managing transfers between Stellar and Azos

Bridge Layer

- Azos API Adapter: Translates Stellar operations to Azos Protocol actions

- Cross-Chain Verification: Ensures transaction validity across blockchains

- Asset Registry: Maps assets between Stellar and the EVM chain

- Event Listeners: Monitors blockchain events to maintain synchronization

Azos Protocol Layer

- CDP Vaults: Collateralized positions for RWAs and regenerative assets

- Stablecoin Issuance: Minting of stablecoins backed by sustainable collateral

Process Flows

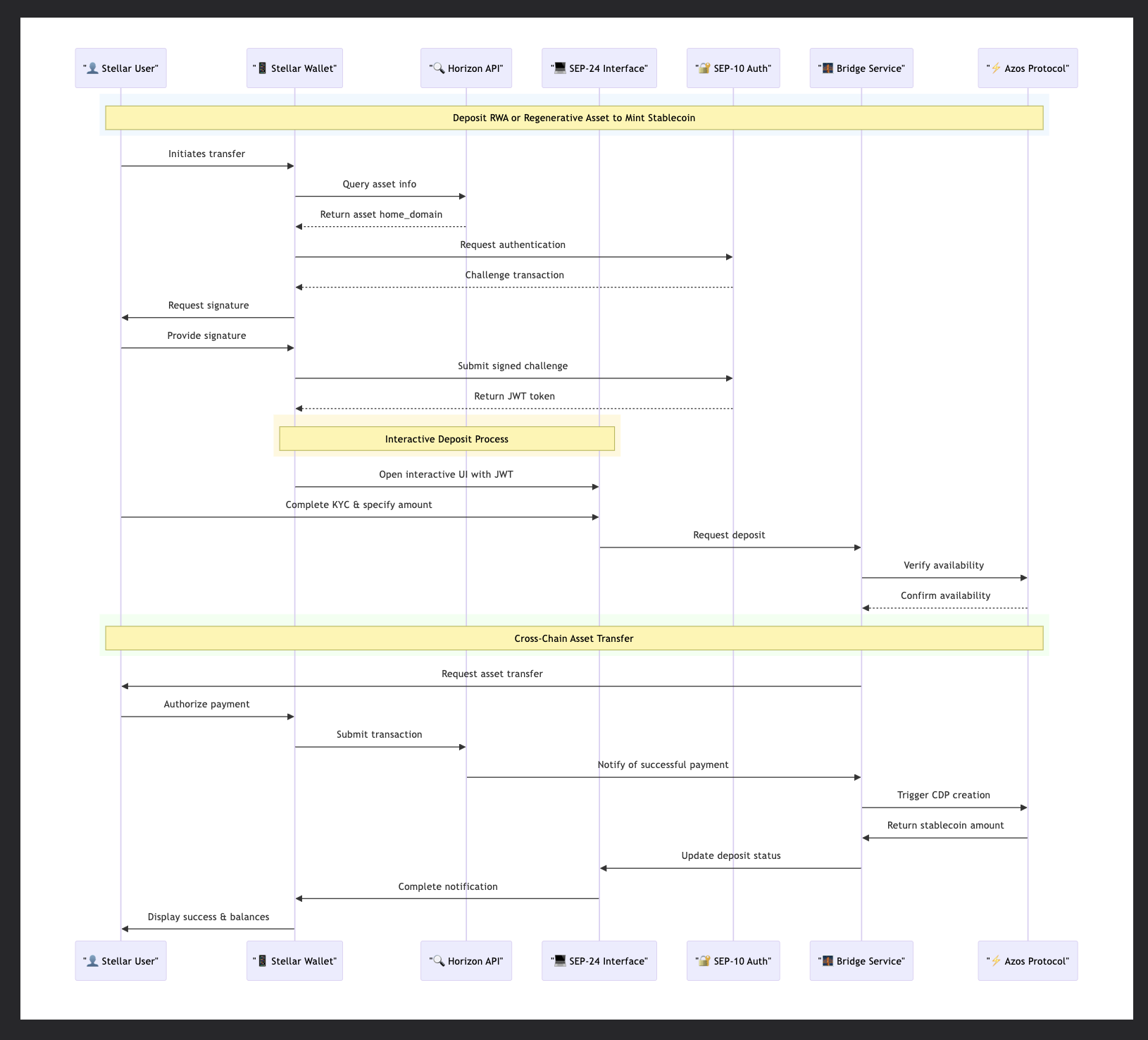

Deposit RWA and Mint Stablecoin Flow

Image: Sequence diagram showing the process of depositing RWA or regenerative assets to mint stablecoins

Minting New Stablecoins Flow

- Initiation: The Stellar user selects "Mint Azos Stablecoin" in their wallet application.

- Interactive Interface: The wallet opens the SEP-24 interface, where the user specifies the amount and type of collateral (RWA or regenerative asset) they wish to deposit.

- Request Processing: The Anchor service receives this request and forwards it to the Bridge service with the necessary minting parameters.

Cross-Chain Operation:

- The Bridge locks the user's collateral on the Stellar side

- Simultaneously, it instructs the Azos Protocol to create a CDP (Collateralized Debt Position) vault on the EVM chain

Stablecoin Creation:

- The Azos Protocol calculates the appropriate collateral ratio, deposits the collateral and mints the corresponding amount of stablecoins on the EVM chain.

Token Issuance:

- Azos protocol sends stablecoins to The Bridge

- The Bridge receives confirmation of the received stablecoins

- The Anchor then issues an equivalent amount of representative stablecoins on the Stellar network

- These tokens are 1:1 backed by the original Azos stablecoins locked in the bridge contract

Completion:

The stablecoins are credited to the user's Stellar wallet, and they see their updated balance.

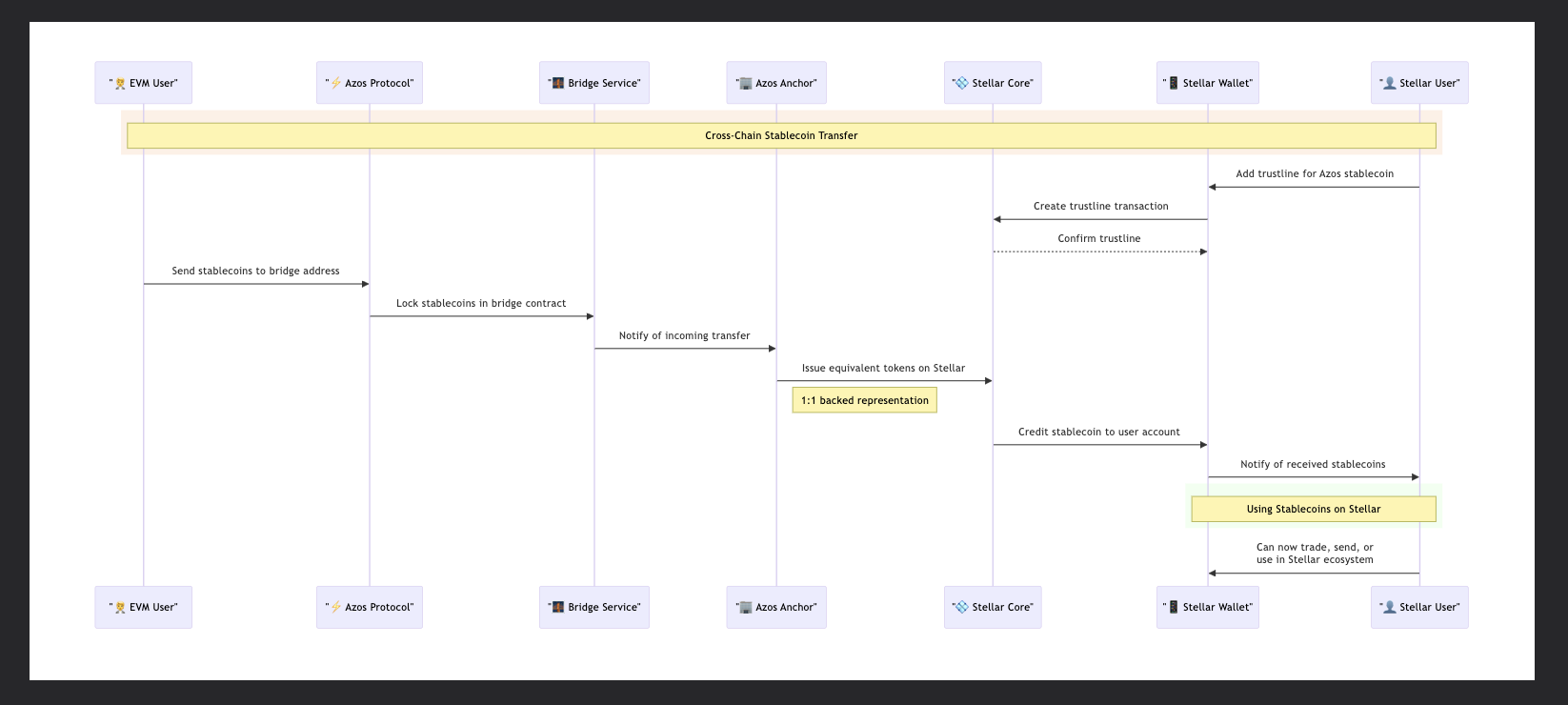

Cross-Chain Stablecoin Transfer

Image: Sequence diagram illustrating how stablecoins are transferred from EVM chain to Stellar network

User Experience

Receiving Stablecoins:

- Set up a trustline (one-time action)

- Receive a notification when stablecoins arrive

- See the balance in their Stellar wallet

Using Stablecoins:

- Trade on Stellar DEX

- Send to other Stellar users

- Use with any Stellar application

- Redeem for original Azos stablecoins via the Anchor